Credit Card Fraud

Any charges related to fraud and theft can attract serious penalties if the judge finds you guilty of the offense. Consequently, you may face detention for extended periods or pay hefty fines. Thus, you want to defend your case by working with an experienced criminal attorney who understands the various court trial procedures. With their help, you are more likely to receive a favorable case outcome that includes sentence reduction or a complete acquittal.

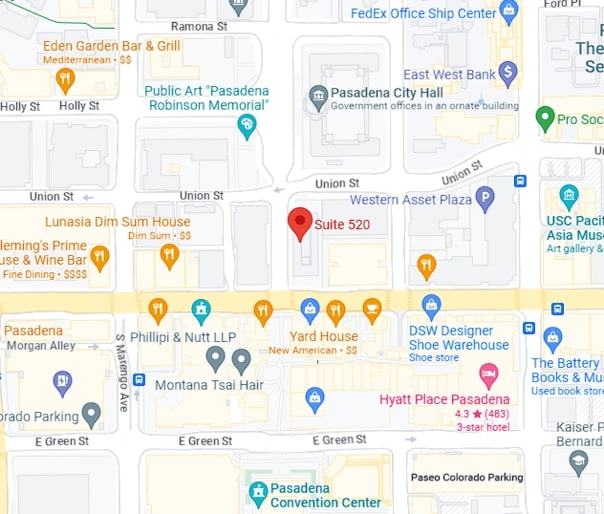

Furthermore, your attorney will help you draft defenses and source relevant evidence to strengthen your arguments. At Michele Ferroni Pasadena Criminal Attorney Law Firm, we work hard to ensure that all clients facing credit card fraud charges in Pasadena, California, receive the best legal representation. Over the years, we have successfully helped hundreds of clients fight criminal charges, making us your trusted partner.

What Credit Card Fraud Entails

The California Penal Code prohibits credit card fraud under section 484g, making it an offense to acquire benefits, goods, or services by using an invalid or unlawfully obtained credit card. Further, this offense falls within the general fraudulent crimes category, attracting either a misdemeanor or felony charge.

Hence, the prosecutor presiding over your case will analyze the important facts to establish whether your violations result in a felony or misdemeanor offense. This depends primarily on the amount of money you obtained fraudulently to classify your actions either under petty or grand theft.

You should also note that credit card fraud cases should bring out the fraud element, as with related offenses. This requirement distinguishes genuine mistakes from actions that violate other people’s privacy and control over their finances. Therefore, you want to consult your criminal defense attorney on the best approach possible in defending your case.

Elements of Crime for the Prosecutor to Prove in Your Case

After your arrest, the presiding prosecutor will file your case, marking the onset of the trial. By this stage, you should have retained a defense lawyer to help you strategize the best defenses to apply to negate the prosecutor’s position.

Moreover, your defense attorney will provide insights on identifying weaknesses in the prosecutor’s case. Finding inconsistencies is crucial, as the prosecutor carries the burden of proof in all criminal cases to establish your guilt. Based on this, the prosecutor must prove your involvement in each crime element and demonstrate that you knowingly violated the law.

Furthermore, the standard of proof for the prosecutor to satisfy is that you are guilty of the accused offense beyond a reasonable doubt. This means that no inconsistencies should be present to validate your actions or your defenses. The prosecutor, therefore, applies diligence in ensuring their case is foolproof. The following are the prosecution team’s strategies and considerations when presenting the elements of credit card fraud:

1. You Used an Invalid Credit Card

Firstly, the prosecutor must show that you used an invalid credit card, meaning that you did not have consent to use it or that it was incapable of transacting successfully. Subsequently, the prosecution team needs to deconstruct the elements of a credit card to determine whether yours was invalid or capable of perpetuating fraud.

Typically, the prosecutor focuses only on the characteristics relevant to your case. However, learning all the possible descriptions used during credit card fraud cases can be beneficial, especially if the prosecutor decides to ambush you. If so, you can identify the inconsistencies in defining the type of invalid credit card you used in your defense.

Characteristics of Invalid Credit Cards

The following are common elements of an invalid card that could result in your conviction for credit card fraud:

Forged cards

Stolen credit cards

Altered card details

Expired credit cards

Revoked cards

Counterfeit credit cards

2. You Used the Invalid Credit Card Knowingly

Secondly, the prosecutor should also show that you knowingly used the invalid credit card. The element of knowledge is crucial in your case because it points toward an accused’s impunity towards the law. Therefore, establishing that you were aware of your actions can prove that you knew of the possible legal violations, yet you proceeded with the transactions.

The prosecutor will often rely on circumstantial evidence to prove your knowledge of the invalid card, as knowledge is a mental factor that may not be obvious. Hence, studying your behavior and drawing conclusions without doubt about your illegal actions is the best strategy for the prosecutor.

You can expect the prosecutor to call on witnesses to testify on your behavior during or after a fraudulent transaction, as the information they provide can quickly point out your state of mind. For example, the prosecutor may call on the cashier who handled a transaction you completed with an invalid credit card. Based on their testimony about your body language, the prosecutor may depict whether you were aware of your unlawful actions.

Further, if you showed any signs of fidgeting or hesitation when giving out card details during payments, the details may help the prosecutor build on your case. Additional signs of trying to hide the card or waiting for specific transaction times will also point to your knowledge of unlawfully using the credit card in question.

Some evidential sources for the prosecutor’s reference include surveillance footage, transaction records, and any communication from banks or online mobile money transfer applications that captured your transactions. Despite this, your defense attorney can still play an essential role in combating the accusations.

3. You Intended to Engage in Fraud

Furthermore, the prosecutor should demonstrate that you had criminal intent to commit fraud, linking the first two elements to the available charge you face. Proving criminal intent is also crucial for the prosecutor, as it is among the two main factors that must be present in all criminal cases.

Hence, the prosecutor will apply extra effort when presenting this element by sourcing several forms of evidence to support their position. You should also note that if the prosecutor succeeds in showing you knew the invalid nature of your credit card, they may have a smoother time proving your criminal intention.

Observing factors include how the prosecutor presents your intention to commit fraud. Usually, fraudulent purposes involve planning on making false representations about your identity, circumstances, and ownership, among others. Therefore, the prosecutor should focus on elements relevant to your case only.

Furthermore, you can expect the prosecutor to specify the specific type of pretenses you relied on to complete the fraudulent credit card transaction. For example, if you face accusations of using a mistaken identity online to pass as a legitimate card holder, the prosecutor should present evidence of the profile you allegedly created. This may be in screenshots or message correspondences where you introduced yourself as the legal cardholder.

Similarly, any accusations about presenting false narratives about your circumstances should also have supporting evidence. Thus, the prosecutor may call on witnesses you interacted with and lied to let you use the invalid credit card.

For example, if you presented yourself as a spouse of the original owner whose name appears on the card, the witness should testify to this effect. Failure to mention specific details leads to inconsistencies, meaning you can attack the integrity of the prosecutor’s case.

Any other case of fraud identifiable by the prosecutor is also acceptable as their argument, including forging card ownership documents and stealing another person’s personal identification number to use as your own.

Overall, the prosecutor will assess each case and apply the arguments accordingly, so you want to be familiar with your case in advance to prevent any chances of misconstrued facts.

4. You Lacked Consent from the Credit Card Owner

Lastly, the prosecutor should prove that you lacked consent to use the credit card in question, meaning that you violated the owner’s privacy and property. Establishing this final element is important because it ties in with your fraudulent intentions and actions. Therefore, any evidence accessible to the prosecutor will likely form part of their case.

The card owner is likely the prosecutor’s primary witness because they can testify when they first began noticing suspicious activity on a registered credit card or discovered it was missing. Similarly, the owner can identify you as someone they had interacted with before if you acquired the card details fraudulently and directly from the owner.

For example, you may have posed as a legitimate bank worker and recorded different clients’ sensitive card details for later use. If so, the card owner will further testify on your interactions with them and whether you had access to their credit card.

Additionally, the prosecutor can prove that you lacked consent by proving you stole the card. Factors related to theft include moving an item from one position to another, no matter how small the distance, to deprive the owner of its possession permanently.

Hence, if the prosecutor can prove that you obtained the credit card through theft, they will have successfully established that you lacked consent to transact with it.

Defenses Applicable to Fight Credit Card Fraud Charges

Your criminal defense attorney is responsible for preparing criminal defenses and counterarguments that expose the loopholes in the prosecutor’s case. Typically, your lawyer should prepare for your defense hearing after receiving your case facts after your first meeting.

Furthermore, you want to remain actively involved in the case to provide your lawyer with as many details as possible for stronger defenses. This is important because the minor details can help you show why the prosecutor’s position is wrong. Ultimately, you will have cast reasonable doubt on the prosecutor's case, increasing your chances of a favorable outcome. The following are applicable defenses against credit card fraud charges:

You Had No Intention to Defraud the Victim

Firstly, you can defend yourself by stating that you did not intend to defraud the card owner, meaning that you were not looking to acquire benefits through pretenses. The defense can take on various argument forms depending on your case circumstances. Despite this, the underlying position should be that the prosecutor did not prove that you engaged in fraudulent operations.

For example, you can argue that you did not take on any fake identity or use false narratives to allow a transaction to complete fraudulently. Similarly, you can attack the prosecutor’s position on having any knowledge about the invalid nature of the credit card.

As you present these points, you want to support your position by presenting evidence contradicting the prosecutor’s position. Discussing the relevant evidential sources with your attorney in advance will be beneficial, giving you the edge during the defense hearing.

You Acted Under Duress

Additionally, you can defend your actions by presenting to the court that you were under duress when undertaking the transactions. Usually, coercion applies when you have no option but to comply with orders from a third party, fearing repercussions for non-compliance.

For example, if a thief held you hostage and ordered you to commit credit card fraud, you may have acted based on your fears, regardless of acknowledging that the offense was wrong. If so, the judge or jury will consider your presentation, and you may receive an acquittal order.

However, you should note that this defense only applies successfully if the threats of violence or other harmful actions are against you as an individual. If the third-party offender threatened to harm others not present when you faced the threats, the court would be less lenient to you.

You Obtained Consent from the Cardholder

Furthermore, you may argue that the cardholder was aware of your card possession and that you intended to complete a transaction using the credit card. This is a good defense to rely on when you know the card owner personally. For example, if they are your spouse, parent, friend, or close relative, your defense is more likely to establish credibility in court.

You can support your position by having the card owner testify in your favor and reinforce your position. Their testimony should confirm that they consented to use their credit card, meaning that the investigation and prosecution team may have overlooked some factors.

However, you should note that during cross-examination, the prosecutor may inquire about the extent of consent the card owner provided. For example, they may have allowed you to hold possession of the credit card but not to transact with it. Thus, your defense attorney should prepare the defense witness in advance to avoid inconsistencies.

There was a Mistake of Fact in Your Accusations

Additionally, fraud cases commonly involve mistakes of fact and identity, meaning that innocent parties may easily face credit card accusations. For example, if you rarely use your middle name during transactions but decide to do so once, the system may pick up on the change. Consequently, law enforcement officers may become involved and arrest you for trial.

Thus, you want to explain the exact predicament resulting in the mistake of fact or identity to avoid facing penalties. Doing so as soon as possible is important, as you may avoid the trial process. However, you will need strong evidential sources to prove your position and establish credibility. With your criminal defense lawyer working on your case, the defense should evoke leniency or complete acquittal orders, provided the details you rely on are legitimate.

Penalties for Committing Credit Card Fraud

After the judge or jury finds you guilty of the offense, you will face a sentencing hearing where you learn the specific penalties you will receive. Noteworthy, your sentence depends on the charge you faced, as credit card fraud offenses fall within the wobbler crime category. The prosecutor may classify your case as a misdemeanor or a felony.

The main factor for the prosecutor to establish before assigning you a charge is whether the credit card fraud you committed amounted to a loss of $950 or more. Any losses below this figure fall within the petty theft category and therefore attract misdemeanor charges.

Conversely, committing fraud that results in a loss of above $950 is grand theft and attracts misdemeanor or felony charges and penalties.

Misdemeanor Penalties

As a misdemeanor, the offense may lead to imprisonment for up to six months in county jail or fine payment orders of up to $1000.

Felony Penalties

As a felony, the offense attracts a sentence of up to three years in county jail or fine payment orders of up to $10,000.

You should also remember that the judge exercises discretion in issuing the sentence depending on the circumstances of your case. Therefore, they may increase or decrease your sentence to the maximum or minimum terms possible.

Additionally, while the common practice is ordering a jail sentence alone, some judges may combine fine payments as additional punishment. This is common where your case circumstances include aggravating factors.

Offenses Related to Credit Card Fraud

Although your main charge may be committing credit card fraud, you want to familiarize yourself with the related charges similar to your case. This is because you may have anticipated a different charge, or the prosecutor may decide to combine the charges, depending on your case circumstances.

As a result, the information may benefit your current and future reference. The three main offenses related to credit card fraud are:

Publishing Credit Card Information

Publishing exposed information to the general public, meaning anyone could access the details. Thus, publishing credit card information, which is highly sensitive, counts as an offense because it exposes the card owner to theft and misuse of funds by strangers.

The judge will find you guilty of the crime by publishing a person’s bank account information, Personal Identification Number(PIN), or computer password details to commit fraud.

Section 484j of the penal code prohibits this offense and classifies it as a misdemeanor. Guilty offenders may face up to six months in jail or a fine penalty of up to $1000.

Shoplifting Charges

Additionally, you may be guilty of shoplifting, contrary to section 459.5 of the Penal Code, and charged with committing credit card fraud. These two offenses often go hand in hand because shoplifting involves entering business premises to steal goods. Some ways to shoplift include using fake or expired credit cards to purchase before the cashier realizes that the card cannot transact.

Typically shoplifting attracts misdemeanor charges, resulting in up to six months in county jail and fine payments of up to $10,000 depending on the goods you intended to steal.

Stealing a Credit Card

You may also face credit card fraud and stealing charges, primarily if the card you committed fraud with belonged to somebody else. The crime involves transferring, buying, selling, or acquiring a credit card holder’s information without their knowledge and consent. You can expect the prosecution team also to source information on whether you involved yourself in theft or violence when acquiring the card. If so, you may face harsher penalties if found guilty.

As a result, the offense may attract felony or misdemeanor charges depending on whether you retrieved any cash from the card. Common cases result in grand theft, as offenders will be guilty of stealing amounts above $950. Hence, you will face similar penalties, including payment of expensive fines or facing imprisonment in county jail.

After facing arrest for alleged credit card fraud, you may be unsure of the following steps to take, primarily if you lack legal representation. On the other hand, your case may quickly move to the trial stage, where you will need to defend your case to avoid conviction. All these events can prove overwhelming when handling the matter alone, so you want to retain a reliable criminal defense lawyer.

With Michele Ferroni Pasadena Criminal Attorney Law Firm, you will receive the best legal representation for credit card fraud charges, thanks to our experience in criminal law. Our team has all the tools necessary to help you successfully contest the prosecutor’s case and secure an acquittal or sentence reduction. We are available for consultation to assist clients in Pasadena, California, and receive reliable defense services to fight credit card fraud charges. For more information, contact us today at 626-628-0564.

Don't Let a Criminal Charge Ruin Your Life!

Get An Experienced Attorney Defending for You. Don't Wait.

Testimonials

Yvonne L.

Jose R.

Jess Y.

Our Services

Don't Fight Your Criminal Charges Alone.

Get Your Life Back On Track. Don't Wait.

Take the First Step Towards Fighting Your Charges

Call 626-628-0564 to speak with our attorneys today. We offer a free initial consultation as we give you the chance to get the answers you need and make an informed decision about your charges. Take the crucial first step of combating your charges and put your life back on track by contacting Michele Ferroni Pasadena Criminal Attorney Law Firm.