Acts of concealing or misrepresentation summarize the definition of fraud. In real estate, these activities lead to losses for real estate investors. Perpetrators of the crime steal from investors through unethical practices that generate an undue advantage for the perpetrators and significant losses for the victims. This situation motivates authorities to convict offenders of the crime to curb the vice.

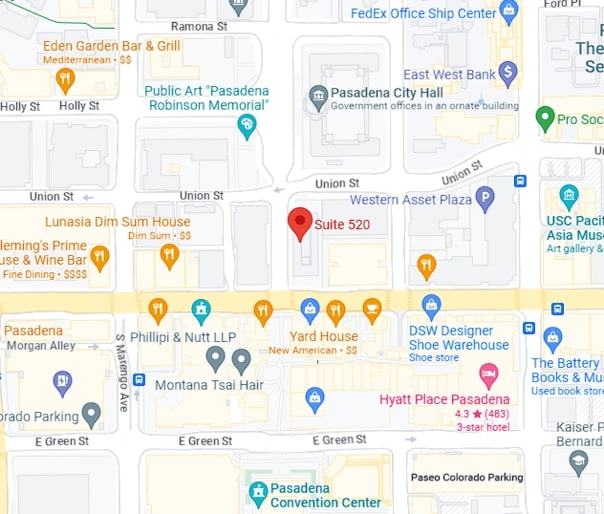

An accusation of real estate fraud is detrimental, not only because it results in time behind bars and possible fines, but it marks a dent in your reputation in the industry. This is both career and financially crippling. You, therefore, need to fight these allegations. If you are accused of or are facing real estate fraud allegations or you are facing real estate fraud charges in Pasadena, do not hesitate. Call the Michele Ferroni Pasadena Criminal Attorney Law Firm. Our team will work tirelessly to ensure we fight off the allegations and for you to receive the best possible legal outcome.

Real Estate Fraud Under California Law

Fraud in the real estate sector encompasses various activities. Primarily, the law violated in real estate fraud is grand theft, a violation of PC 487. This law penalizes individuals who unlawfully take another’s property, money, or labor valued at $950 or more.

Unlawful, under real estate fraud refers to false pretenses a real estate agent employs to defraud an investor.

$950 is a low threshold given the value people invest in properties. The penalties under PC 487 too, according to authorities, are not sufficient for anyone convicted of real estate fraud. Therefore, prosecutors incorporate other statutes to significantly increase the penalty if convicted. The laws include:

- PC 115 — This law criminalizes any filling of false or forged documents

- PC 487 — Law prohibiting grand theft

- Civil Code 890 — This statute punishes individuals convicted of rent skimming

- Civil Code 2945.4 — Under this statute, it is an offense to participate in foreclosure fraud

Looking at the various types of real estate fraud will help better understand the various activities considered before charges are brought forth.

Categories of Real Estate Fraud

The real estate business is cut-throat. It is highly competitive and some agents have become creative in their practices over time to maximize their returns. These practices have been adopted and some agents are unable to differentiate whether the practices violate specific statutes or are legal.

Real estate fraud falls into the following categories.

- Forged or false documentation

- Rent skimming

- Foreclosure fraud

- Unlawful property flipping

- Straw buyer schemes

- Predatory lending

- Theft By False Pretense

1. Forged or False Documentation

It is a crime to knowingly register, file, or record a forged or falsified document with a state or government agency. Any attempt to forge or falsify a legal document is also a crime under PC 115.

Attempting to offer property for sale or acquire a loan with a fraudulent deed is also deceitful and likely to attract PC 470 and PC 115 charges.

2. Rent Skimming

You violate Civil Code 890 if you participate in rent skimming. The offense occurs in two ways.

The first involves a defendant renting out a residential property during the first year of its acquisition and failing to apply the rent proceeds to the mortgage on the property.

The other way involves pretending to own property, fraudulently renting out without the authority to do so, and retaining the rent proceeds.

First-time rent skimmers or one-time rent skimmers only face civil lawsuits. However, multiple rent skimmers face criminal proceedings.

3. Foreclosure Fraud

Many homeowners or property investors face foreclosure owing to their inability to pay mortgages on their homes or property. This situation creates an opportunity for foreclosure solution providers, some of whom target their victims to unfairly and illegally gain an advantage of their victim’s predicament. Most homeowners and property investors then end up falling victim to foreclosure fraud.

Under Civil Code 2945.4, you are liable for criminal prosecution if you:

- Charge or collect exorbitant fees for your services

- Charge or receive compensation for services you promised to perform on a property investor’s or homeowner’s behalf but are yet to provide the services

- Take over property or receive funds from third parties as compensation for the services offered to the property owner without informing the property owner.

- Require security for repayment, charge interest, or assume lien of property under foreclosure — A good example is renting out property to the individual you bought it from

- Defrauding a property owner into signing an illegal agreement

- Obtaining the power of attorney from the property owner, a document that confers upon the holder the power to act or engage in business or legal matters on behalf of another

Foreclosure fraud is achieved in various ways, including:

Title Transfer

You commit foreclosure fraud by title transfer when you, in your capacity as a foreclosure consultant, convince the property owner to sign the house’s title over to you. You offer an assurance to the owner that they can ultimately repurchase the property if they become your tenant. However, you obtain the property’s existing equity upon purchasing the property.

Phantom Help Scams

As the name suggests, phantom help scams refer to activities that require property owners to pay for the services upfront, but the foreclosure consultant fails to offer the services.

Phantom help scams occur in three ways:

- When a mortgage modification specialist or a foreclosure consultant engages a property owner whose property is about to be foreclosed. He/she then charges an upfront fee to prevent or delay foreclosure proceedings. However, the consultant barely honors this agreement, and the homeowner only realizes the consultant’s actions when they face an imminent foreclosure.

- A property owner markets the property under foreclosure to a homebuyer who does not understand how title insurance or escrow works. The seller (the defendant) then receives the downpayment and turns over the fraudulent agreement. This document does not entitle the buyer to the property he/she believes they purchased. The buyer moves in, pays rent to the foreclosure consultant (the seller of the property), but is evicted by a legitimate buyer who acquired the property from the bank.

- When a consultant convinces the property owner not to engage with their attorneys, lenders, or credit counselors because he/she is taking care of the agreements. During this process, the consultant convinces the property owner that he/she will act as the liaison with the bank. The property owner then channels mortgage payments directly to the consultant, who disappears after receiving a few payments.

Bait and Switch

Unlike title transfers, for bait and switch foreclosure fraud, property owners are unaware that they are signing over the title to their property over to you, the consultant.

The following ways amount to bait and switch, which prosecutors rely on to make a case against you.

- Presenting to the property owner a blank document to sign with the promise to later fill in the agreed terms

- Convincing the property owners to sign over their property or home to you on the pretext that the documentation will secure lower mortgage payments

- Presenting a document with ineligible or confusing writing thus making it impossible for the property owner to comprehend what they are signing to

4. Unlawful Property Flipping

Illegal property flipping is mostly carried out by property appraisers, mortgage brokers, or realtors. You commit this offense when you wrongfully inflate a property’s value through a fraudulent appraisal. You then use the inflated price to convince an unsuspecting buyer to purchase the property or a bank to extend credit based on the inflated price of the property.

It is worth noting buying a property, renovating it, and selling it at a markup is legal flipping.

5. Straw Buyer Schemes

Straw buyers acquire property on behalf of another for several reasons, top on the list being credit rating. The actual buyer engages the straw buyer to buy property on his/her behalf because the actual buyer’s bad credit hinders him/her from doing so. With a good credit rating, the straw buyer secures a mortgage on the property. The property is then transferred to you, the actual buyer, in exchange for some form of compensation to the straw buyer. After acquiring the property, you default on the mortgage payments, and thus, the straw buyer will be liable for the defaulted payments.

In most situations, straw buying details are not disclosed to banks. This scheme is unpopular with financial institutions because of an increased risk of default.

6. Predatory Lending

Predatory lending occurs when a mortgage broker offers a refinancing loan product packed with exorbitant fees that do not add to the value of the refinancing plan to the borrower. In the refinancing plan, you maximize commissions absent any consideration for the buyer’s ability to repay the loan.

In most cases, predatory lending occurs in the following ways.

- Through open and direct deception

- Imposing exploitative and unreasonable terms on borrowers — This is accomplished through aggressive sales and marketing strategies.

- Taking advantage of a borrower’s ignorance of complex transactions

7. Theft By False Pretense

Individuals violate PC 487, grand theft, by defrauding another individual out of their property or money by making false representations or promises. You must have:

- intentionally deceived a mortgage broker or a property owner, and

- deceived the property owner or mortgage broker through false representations or promises

to be found guilty of the crime. Additionally, the alleged victim must have relied on your promise and transferred the property or money to you.

Penalties for Real Estate Fraud

Penalties are issued based on the prevailing circumstances of the case and the particular statute you violated. Here’s a look at the penalties each law issues for violating its provisions.

Forged or False Documentation

A violation of PC 115 is a felony. The offense is punishable by a sixteen-month, two, or three-year prison sentence or formal probation instead of prison time. A fine of no more than $10,000 will also be imposed.

Grand Theft

A conviction for theft by false pretense attracts PC 487 penalties. The crime is a wobbler, meaning prosecutors can pursue misdemeanor or felony charges.

Being convicted of a misdemeanor translates to a jail sentence of up to one year or summary probation instead of jail time. Moreover, the judge could impose a fine of up to $1,000. Felony offenders, on the other hand, risk a maximum jail sentence of up to three years. A conviction could also require a monetary penalty of no more than $10,000 to be paid.

Rent Skimming

For rent skimming, what is paramount is whether it is single or multiple instances of rent skimming. As pointed out earlier, one-time rent skimming cases result in civil proceedings. Plaintiffs will seek restitution equal in value to the loss incurred, legal and attorney fees, and any additional costs, where applicable.

Multiple rent skimming instances are punishable by misdemeanor or felony penalties upon conviction. Misdemeanor charges are punishable by summary probation or a jail term not exceeding one year. A judge could also require you to pay $1,000 in fines.

Felony convictions, on the other hand, result in jail time of sixteen months, two or three years, or formal probation instead of jail time. Additionally, a fine of up to $10,000 will be imposed.

Foreclosure Fraud

Under Civil Code 2945.4, foreclosure fraud is prosecutable as either a misdemeanor or a felony. The circumstances of your case and criminal history inform the prosecution of whether to pursue misdemeanor or felony charges.

Misdemeanor convictions result in no more than one year in jail or summary probation instead of jail time. A judge could also require you to part with up to $10,000 in fines.

By contrast, felony convictions are punishable by a sixteen-month, two, or three-year prison sentence. You could also be required to pay no more than $10,000 in fines.

Foreclosure fraud convictions also result in additional penalties in the following circumstances.

- If the property owner or tenant incurred a loss north of $65,000, four years would be added to your prison sentence to be served consecutively.

- If convicted of more than two or more felonies in the same case and the property owner incurred a loss of $100,000, you will receive four additional years to your prison sentence to be served consecutively. Additionally, a fine of $500,000 will be imposed or double the value of the fraud, whichever is greater.

- Restitution fees to the victim

Additional Penalties

Courts would impose further penalties if the alleged victim suffered a significant loss. The punishment is as detailed below.

- An additional one year in prison should the victim suffer a loss north of $65,000

- An additional two years if the victim’s losses total more than $200,000

- An extra three years in prison should the victim suffer losses exceeding $1.3 million

- A further four years should the victim lose more than $3.2 million

The courts will add a further five years to the prison sentence should the victim lose north of $100,000 and you receive at least two felony convictions for any real-estate fraud-related charges.

Fighting a Real Estate Fraud Charge

The ideal defense strategy ensures your case is dismissed or your charges are reduced. It is best to engage an attorney with experience in real estate fraud to improve your chances or the best possible outcome. Here are some common defenses your attorney could employ.

Lack of Fraudulent Intent

Prosecutors have to prove that you intended to commit fraud beyond a reasonable doubt. Failure to which, your attorney can introduce the lack of intent as a defense. Your attorney will present evidence to show that your actions were an honest mistake, born of good intentions, or the result of misrepresenting your actions, all acts that lack the intent to defraud others.

False Accusation

Your competitors and clients all have motives to accuse you of fraud falsely. A false accusation is incentive enough for competitors to eliminate competition. As for your clients, one could decide to repossess his/her property back and accuse you of fraud to avoid the legal process of buying back the property.

Another party could use your name to conduct illegal transactions in other instances. Thus, implicating you to criminal activities, you did not participate in or are unaware of.

Your attorney will present the false accusation argument and evidence to support it in the above cases.

The Property Owner Gave Consent to the Transaction

It is common for people to second guess their decisions, especially when money is involved. If a property owner does so and wants to reverse their decision, he/she could claim they did not consent to the transaction to avoid the legal hurdles of a binding contract.

In other situations, if you dealt with an elderly individual, he/she could have forgotten they consented to the transaction, thus accusing you of acquiring their property fraudulently.

Both situations can be challenged by showing the entire engagement between you and the property owner up to its conclusion, the signing of the agreement. In the process, your attorney will focus on how the property owner participated in each step showing consent in all your accuser’s decisions.

You are a Victim of Entrapment

Authorities may conduct investigations based on a tip. Since they lack sufficient evidence to prosecute you, they decide to set up a sting operation to implicate you in a fraudulent real estate transaction. In almost all cases, these operations end up with the target committing a crime.

Entrapment is common. An experienced attorney’s insight into the trickery authorities use will be pivotal in proving your innocence.

Lack of Justifiable Reliance

Prosecutors should establish that the alleged victim suffered significant loss owing to the reliance on any information you offered in your capacity as a realtor, mortgage consultant, or mortgage broker. A direct link must exist between the losses and the reliance on the information you provided. However, if your accuser incurred losses because of any other reason other than the reliance on the information you provided, you can argue the lack of justifiable reliance to fight the fraud allegations.

Mistake of Fact

Some of the activities detailed as crimes are common in the real estate industry. Some players may reasonably participate in the activities, believing that the actions are legal. In this case, prosecutors have to prove beyond reasonable doubt that you knowingly carried out a transaction aimed at defrauding your clients. However, if you reasonably believed you followed the law and the industry’s best practices, you could argue your actions were a mistake of fact. That is, you reasonably believed that the statements your clients relied upon were factual.

No Loss Suffered

Alleged victims must have suffered loss because of relying on your advice. The loss has to be $950 or more as per PC 487. The lack of financial loss presents a challenge for prosecutors in pursuing the real estate fraud charge. Should they decide to move forward with the case, you can argue that the alleged victim suffered no loss through your attorney.

Illegal Search and Seizure

Authorities are bound by the Fourth Amendment rights that protect suspects from unreasonable search and seizure. Police need a warrant or your consent to search your premises. Failure to which any evidence obtained in the illegal search and seizure is inadmissible. Therefore, your attorney will seek a motion to bar the prosecution from introducing into evidence any material obtained from the unlawful search and seizure. This situation is likely to result in your case’s dismissal.

Consult a Pasadena Real Estate Fraud Criminal Defense Attorney Near Me

Real estate fraud allegations are consequential. You cannot turn a blind eye to the adverse impact on your professional, social and financial engagements. Besides time behind bars and the fines, you also risk losing your professional license, not to mention the hit your reputation in the real estate business will take. A conviction will severely cripple your ability to resume your life as you know it. However, you can mitigate the consequences of a real estate fraud charge by hiring an experienced fraud crimes defense attorney.

At Michele Ferroni Pasadena Criminal Attorney Law Firm, we offer legal aid to individuals facing real estate fraud charges in Pasadena. Give us a call today at 626-628-0564, and let us fight in your defense against these charges.